A conventional flow of thought would suggest that given the recent global economic meltdown, the luxury business is ought to be worse hit. Well, this trend has become a passé with Financiere Richemont SA posting double digit growth rate in recent times. The Swiss luxury mills reported 37 percent rise in sales partly owing to its recent acquisition of Net-a-Porter.com.

Their increase in sales is because of Hong Kong emerging as one of the biggest market for Swiss watches with shoppers from Mainland China buying timepiece to avoid incidence of luxury tax. Barring gains from currency moves, sales and Net-a-Porter acquisition alone contributed to the rise of as much as 22 percent.

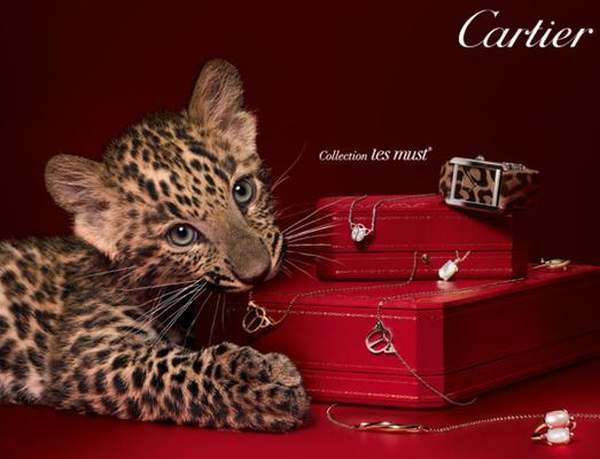

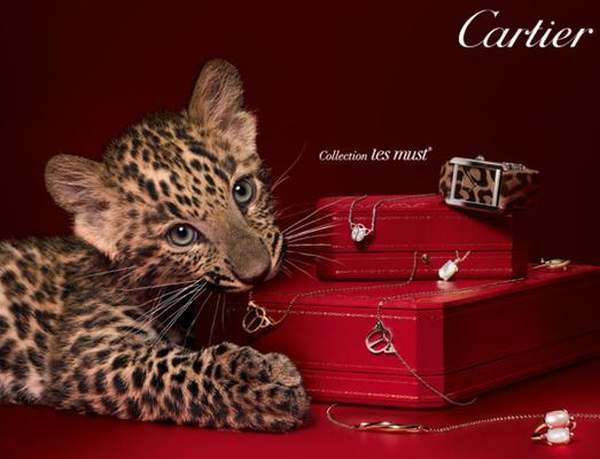

Richemont is the eight biggest company in Swiss Market Index and has jewellery, watches, writing instruments and clothing as its four major segments of business. Cartier, Van Cleef & Arpels, Piaget, Alfred Dunhill and Chloe are some of its fully owned subsidiaries. It is known to share the luxury good market with players like LVMH and PPR.

Via: LiveTradingNews