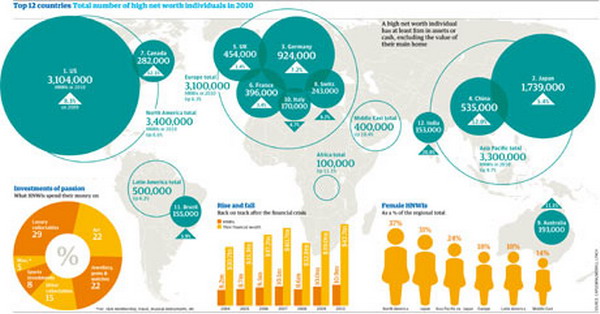

The rich are getting richer and swelling the ranks of millionaires worldwide, the World Wealth Report 2011 compiled by Merrill Lynch and Capgemini has found. The report also found that the wealthy are increasingly investing in art, and luxury items like luxury cars, boats and jets. The effects of the global financial crisis have not quite disappeared yet. Countries like UK and USA are on the slow road to recovery, and Greece is in a precarious financial position. But the richest individuals in the world appear to have largely gotten over the recession and are richer than in the pre-recession days.

The ranks of the High Net Worth Individuals (HNWI), people with over $1 of liquid cash, has swelled since the recession to 11 million worldwide. In 2010, even as national economies struggled to stabilize their finances, the HNWI group increased its wealth by 10 percent to clock a total annual wealth of $42.7 trillion. Thus, they crossed the pre-recession peak of $40.7 trillion recorded in 2007.

However, even within this group there is the class of the super-rich or Ultra-High Net Worth Individuals (UHNWI), who have free cash of $30 million. This group increased its numbers worldwide by 10 percent to reach 103,000. Meanwhile, their investments grew to $15 trillion, an increase of 11.5 percent. In effect, the UHNWI group accounts for 36 percent of the total wealth of the HNWI group. Yet, they form only 1 percent of this group of millionaires.

As of now, about 80 percent of this millionaires’ club is over 45 years of age. About a quarter is women, with North America producing the most woman millionaires at 37 percent, and the Middle East producing the least with 14 percent. But all eyes are on the fast-growing economies of the Asia-Pacific region, particularly India and China. In the Asia-Pacific region, the wealthy are quickly increasing their wealth. They look poised to overtake North America soon.

In India, the ranks of the wealthy swelled by 20.8 percent to reach 153,000. The Asian nation has now grabbed a place among the Top 12 wealthiest nations. Compare the Indian growth rate with those in Britain (1.4 percent), Germany (7.2 percent) and the United States (8.3 percent). Meanwhile, Italy, which holds the No. 10 spot, actually witnessed a reduction in the numbers of its wealthy from 190,000 to 170,000.

The World Wealth Report also discovered that the wealthy are increasingly making investments of passion by buying art, luxury cars, watches, wines and other such collectibles. The low interest rates and unstable stock markets are fuelling this trend. Such investments of passion offer the buyer a refuge from the uncertainties of the traditional investment market. In 2010, luxury cars, jets and boats accounted for a third of these investments.

This trend is clearly visible in China, where wealthy investors have been buying more Mercs and Ferraris. Millionaires in China who have recently come into wealth are seen often in art galleries and auctions, trying to snatch up artworks by local artists.

Globally speaking, the art market is on the upswing, as are diamond and gold jewelry. However, the report warns against unwarranted optimism, saying that the journey to worldwide recovery will be uneven, with aftershocks of the recession affecting growth in 2011 as well.

Via: Guardian