China is central to the luxury story today. Most of the plans being outlined at the Reuters Luxury and Fashion Summit 2011 are focused on China. The luxury retail segment in Europe and the US is wooing the Chinese tourists to give a boost to the retail sector. But one thing is clear that the fundamentals of the luxury industry are growing stronger and there is every reason to be optimistic about the future. Hostile takeover bids would be difficult to execute as finances for expansion of luxury business is available freely. China used to be the factory for the world but it is the market for the luxury industry now. Sourcing of luxury products from China is going down as the costs rise there. In any case the China growth story is intertwined with the resurgence of the luxury industry.

Today we have ten top stories from Reuters Luxury and Fashion Summit 2011 that combines the excitement generated by the rapid pace of growth and the challenges faced by the industry due to the rising costs and the scant supply of skilled manpower.

1)Moda Operandi taps VC interest in fashion

BRAND: Moda Operandi

REPRESENTATIVE: Aslaug Magnusdottir, CEO

The Trend : The growing interest in online luxury retail sees Moda Operandi, an e-commerce site launched in February raise second round of funding.

Aslaug Magnusdottir, CEO of Moda Operandi was speaking on day 2 of Reuters Luxury and Fashion Summit in New York. She was very upbeat about the prospects of her site as she had tied up the second round of funding. The investor interest has increased in the sector with the resounding success of Gilt and Rue La La and the high valuation of Net-a-Porter for acquisition. The first round of funding was done by Boston-based venture capital firm New Atlantic Ventures. The site hopes to have 100,000 members by the end of the year.

2)Saks says visa rules dent U.S. luxury sales

BRAND: Saks

REPRESENTATIVE: Steve Sadove, CEO

Appeal : The US government should make it easier for tourists to come to New York City and spend to help the luxury retail sector.

Only Canadians and Western Europeans get visa waivers when they visit US as tourists. All others need visas that now costs a lot and takes weeks to process. Steve Sadove, CEO of Saks used the platform of Reuters Global Luxury and Fashion Summit to appeal to the government to correct the situation as tough visa rules keeps out many tourists with voracious appetites for designer gowns, $8,000 handbags and Armani suits. The Asian, Brazilian and the Russian tourists contribute the most to the European luxury retail sales.

3)Strategic says luxury is service, not soap

BRAND : Strategic Hotels & Resorts

REPRESENTATIVE: Laurence Geller, CEO

The Strategy: Amenities don’t earn you the loyalty of guests any more. You can get it through personalized service alone.

Laurence Geller, chief executive officer of Strategic Hotels & Resorts is very clear in his mind that personal service, though more expensive, is the most effective way of securing customer loyalty. He was talking at the Reuters Global Luxury and Fashion Summit on Tuesday. He believes that the way forward is to recruit on campus and pay higher salaries to attract the best talent. He also feels that innovative use of technology will help hotels tailor their service to the individual guest.

4)Barbara Bui moves production to Europe

BRAND : Barbara Bui

REPRESENTATIVE: Jean-Michel Lagarde, Deputy Chief Executive

Outlook : The brand is shifting back part of its production from Asia to Europe and expects a growth in sales this year of close to ten percent.

The brand has recovered from the negative growth last year and is on track to post a small net profit again. The wholesale distribution networks have recovered and are expected to grow by 7 to 8%. The wholesale network contributes two thirds of the annual sales for the brand. Jean-Michel Lagarde, Barbara Bui Deputy Chief Executive was confident about posting positive results this year while talking at the Reuters Global Luxury and Fashion Summit in Paris. They have brought down their Asian sourcing from 30% to 15% and shifted it to Eastern European countries that would allow regular interaction with manufacturers and a tighter quality control.

5)Japan’s Shiseido aims to beat China market growth

BRAND : Shiseido

REPRESENTATIVE: Hisayuki Suekawa, President

The Plan : The cosmetic giant from Japan aims to grow their China business faster than the market growth.

Shiseido’s President Hisayuki Suekawa declared during his interview at the Reuters Global Luxury and Fashion Summit that he wishes to surpass the growth rate in the Chinese market and increase their overall share of the market. Their 5,000 specialty stores in China work as their growth engine as the sales in Japan are slipping. The increasing costs of production in China has made them look for local raw materials to bring down the costs and achieve the desired growth.

6)Suitors line up for Jaeger and Aquascutum

BRAND : Jaeger and Aquascutum

REPRESENTATIVE: Harold Tillman

The Stand : There are many suitors for British luxury brands Jaeger and Aquascutum but the majority owner insists he is not looking for a deal.

Harold Tillman, the majority owner of British luxury brands the 127-year-old Jaeger and the 160-year-old loss-making Aquascutum was approached by a Middle Eastern suitor in February. Since then they have been approached by a range of parties exploring the possibility of acquisition. When asked during an interview at the Reuters Global Luxury and Fashion Summit if he would accept a 100 million pounds offer, Tillman said, ‘never say never’. But he clarified that he was not looking for a deal and it was business as usual.

7)The Pace of Change Startles the Luxury Brands

BRAND : Multiple brands

REPRESENTATIVE : Senior executives of various brands

Out look :The pace of change consistently beats the estimates and forecasts made by experts and analysts.

Several of the top executives from brands like Italian car maker Lamborghini and jeweler Harry Winston were very excited about the China growth story and were amazed by the passion for true luxury in China. They told the Reuters Global Luxury and Fashion Summit this week that Chinese rapid change can befuddle them. There are no limits in China and nothing is too big, nothing is too beautiful, nothing is too expensive for the Chinese today. In a short span of time China has become the second home for brands like Hermes, Prada and Tiffany.

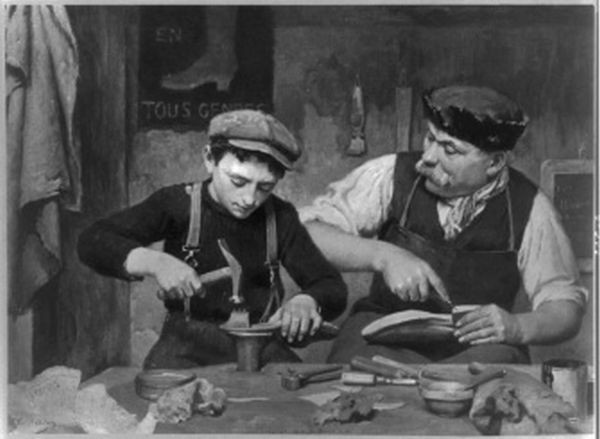

8) Luxury groups struggle to find artisans

BRAND/ORGANIZATION : Comite Colbert

REPRESENTATIVE : Elisabeth Ponsolle des Portes

The Trend : The young generation today is not motivated enough to train and learn the crafts that contribute to creating a luxury product.

The demand for classy handbags, fine jewelry and quality timepieces is on the increase but finding qualified artisans is becoming a struggle for the industry. Elisabeth Ponsolle des Portes of French luxury lobby Comite Colbert and few other executives highlighted this point during their interviews at the Reuters Global Luxury and Fashion Summit. The attitude of the youngsters has changed and they are looking for instant fame and money. Apprenticeship seems to be a waste of time for them.

9) Coty says high-end perfume sales rising most

BRAND : Coty

REPRESENTATIVE : Bernd Beetz, Chief Executive

Trend & Strategy : Coty finds that the high end products are driving the growth and they will continue with celebrity endorsement to support the marketing effort.

Coty Chief Executive Bernd Beetz is excited about the trend of the market. He told the Reuters Global Luxury and Fashion Summit that luxury and ultra luxury are more in demand and are driving their growth in sales. They are on course to meet their annual sales target of $4 billion in June and continue with double digit growth. The magic of celebrity to sell their perfume works for them very well and they plan to continue with it. They would be launching a fragrance linked to pop star Lady Gaga next year.

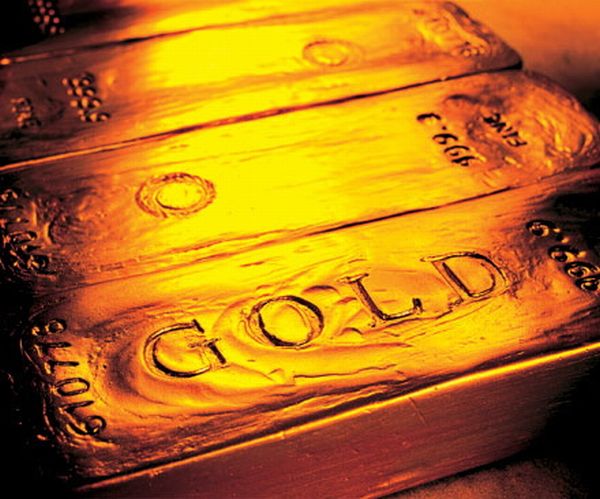

10)Rising raw prices to hurt luxury margins

BRAND : Multiple

REPRESENTATIVE : Various top executives

Status : The phenomenal rise in input costs have squeezed the margins for all the luxury brands.

The economic recovery has brought in the inflationary pressures. A weak dollar has added to the pressures on precious metals that are seen as alternative investments. Various executives voiced their concern at the Reuters Global Luxury and Fashion Summit. The price increases has only offset part of the higher costs and it is not possible for the brands to increase prices every time their cost goes up. Proper planning can help keep up the operating margins.