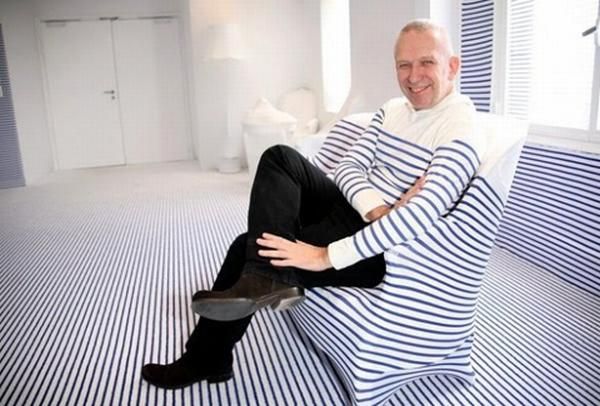

The tussle between LVMH the luxury conglomerate and Hermes, the family owned French fashion house is not over yet. Hermes has been resorting to several measures to retain its autonomy. The fashion house announced yesterday that it is negotiating to sell its 45% stake in the Jean Paul Gaultier fashion house. Jean Louis Dumas, the former patriarch of Hermes had originally hired Gaultier in 2003 to design ready to wear collections. His headline grabbing couture did bring a buzz to Hermes but they never tried to build it into a high profile, high fashion brand to be positioned against the likes of Gucci or Christian Dior. Hermes had bought 35% stake in the Gaultier brand in 1999 for $23 million and again bought 10% from the designer in 2008 for 3 million euros.

Aforge, a French firm specializing in mergers and acquisitions is handling the transaction and negotiating on behalf of Gaultier. Damien Bachelot, the president of the firm clarified that Mr. Gaultier does not want to sell but basically needs a partner. 2009 was a bad year for Gaultier but 2010 saw them recover a lot of the lost ground. Hermes is also not exactly rushing to exit. Christelle Denef, a spokeswoman for Hermès, did not clarify their position. She was not even willing to confirm if Hermes would their entire stake in Gaultier.

LVMH had earlier aggravated the situation by buying a 20% stake in the company but their spokesman Olivier Labesse clarified that they were not interested in buying the Hermes’ share in Gaultier. Jelka Music, a spokeswoman for Gaultier, was only willing to say that Hermes has been approached for their stake but was not willing to comment on what could be the future course of events. In any case Gaultier’s seven year honeymoon with Hermes was over soon after Mr. Dumas’ death last May. Just two months later the designer withdrew from his role and was eventually replaced by Christophe Lemaire who was designing for Lacoste since 2000.

Mr. Gaultier is looking to raise capital to develop his ready-to-wear line more aggressively in Asia and North America and Hermes is going to support him by selling their shares to a partner who would agree to such a strategy. The designer may also seek to raise additional capital separately at a future date. There are several bidders for the stake. Some of them are International luxury brands who would like to expand their portfolio and at the same time help it grow into a truly global brand. There are some Asian firms also in the race who may not necessarily be in luxury but have strong infrastructure in the region and can ensure efficient distribution. The Gaultier fashion house has been recovering steadily from the serious drop in sales during the economic crisis but they still get most of their revenues from ready-to-wear licenses and perfumes, and to a lesser extent, from sales of accessories. The economic crisis had hurt most of the high end fashion brands badly. The process of recovery is resulting in realignment in the luxury industry. The other major developments in the industry has been the announcement by Prada that they would raise cash and get listed on the Hong Kong exchange and LVMH taking over Bulgari.

Via: dealbook.nytimes, bloomberg