A new study by Bain & Company has predicted that growth in the luxury goods industry will run into double digits this year. The results of the study, which were published on Monday, revealed that the luxury sector would be worth 191 billion euros this year. This upswing in the luxury industry appears to be fuelled by the recently acquired luxury spending habits of affluent Chinese customers.

It must be acknowledged that the overall global economic scenario is difficult. However, the tough global economy does not seem to be an obstacle for the luxury sector. The Asian markets are giving a happy boost to the luxury sector. However, it is unlikely that 2011 will see the kind of growth witnessed in 2010. According to Bain & Company, 2010 was represented something of a catching up following the low luxury spends recorded in 2009. The rise in spending is expected to ease up this year.

In May this year, Bain & Company had forecast luxury goods sales growth at 8 percent. The firm has modified the earlier prediction, pitching it at a more optimistic 13 percent. Among the reasons for the revision are the return of Europe and the United States to the growth path and Japan’s commendable recovery following devastation from earthquakes.

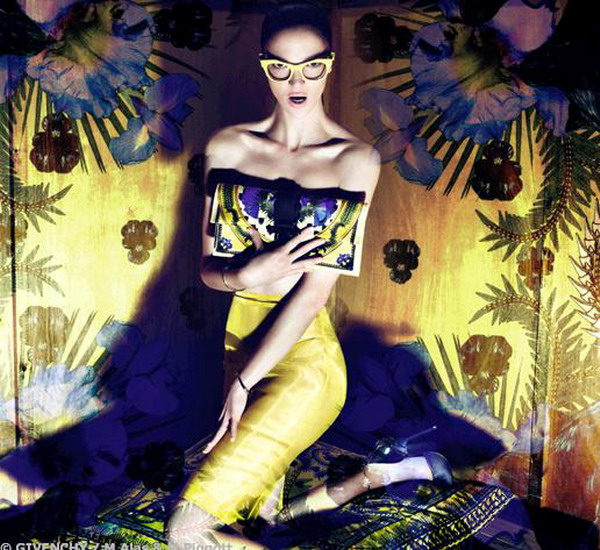

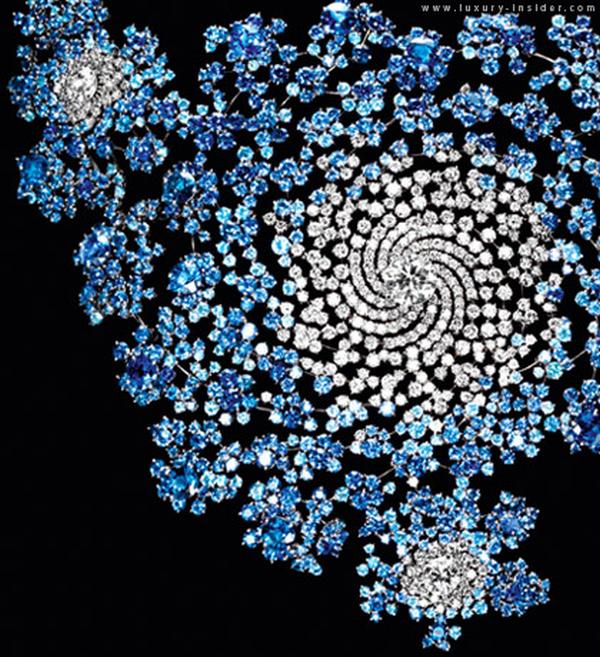

According to the study, hard luxury items like jewelry and watches will see the most growth at 18 percent. Coming in a distant second are accessories like handbags with a growth rate of 13 percent. Luxury conglomerate LVMH’s awaited third-quarter sales figures will provide another indication of the state of sales. Earlier this month, Burberry announced that there was no drop in demand for its luxury products.

Meanwhile, luxury trade body Altagamma is predicting steady growth in 2012. It has forecast that margins of luxury firms will rise by 10 percent over the next year.