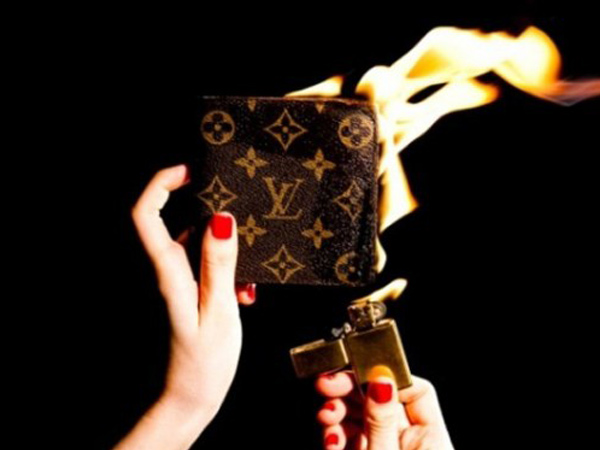

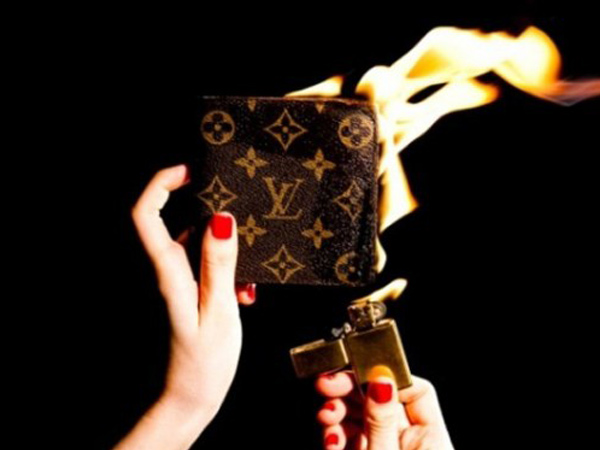

Insurance companies in India are targeting the High Networth Individuals with innovative policies that provide cover for their personal possessions like clothes, shoes and bags. Tata AIG is the most active company in this field. Ramesh Ramani, their Senior Vice President explained that in case there is a spill or tear in your expensive designer clothing, its repair expenses will be reimbursed under the policy. Then again, if a luxurious designer handbag is stolen or lost in transit, the insurance cover will make good its loss. There is a definite demand for under writing such policies as the value of wardrobe and accessories of HNIs have become as much as the price of a small apartment.

The Annual Premium is Generally 1% of the Value of the Item

The policies are designed to cover personal items against calamities like fire, earthquake, flood and terrorism, and, in some cases, burglary, theft, accidental damage and accidental loss. The trend is new in India and the insurance companies are willing to customize the policies according to the client’s requirements. The annual premium for covering clothing is generally 1% of the total value of the garment. The companies are very accommodating at the moment and take the client’s word while assigning value to the items insured without insisting on receipts or proof of purchase. However they do some background checks on their own.

The Companies Are Accommodating and Willing to Customize Policies

The process of making a claim and the corresponding reimbursement is very simple at the moment. A typical example is of a client with a comprehensive policy for his personal effects. He wanted to replace his bags as one of them was stained. The cost of the bags according to him was Rs. 2 Lakhs. The company simply determined what they call the ‘salvage value’, or the price at which it can be resold. It was again the client who pegged the salvage value at Rs 50,000 and the company simply compensated him with Rs.1.5 lakhs. In case of accident the insurer covers the repair cost. Tata-AIG is targeting the ultra HNIs and offering a cut-to-fit ‘Private Client Group’ insurance to cover personal assets of the client and his/her family members. With the growing luxury market in India such insurance services will be more in demand.

Via: luxpresso